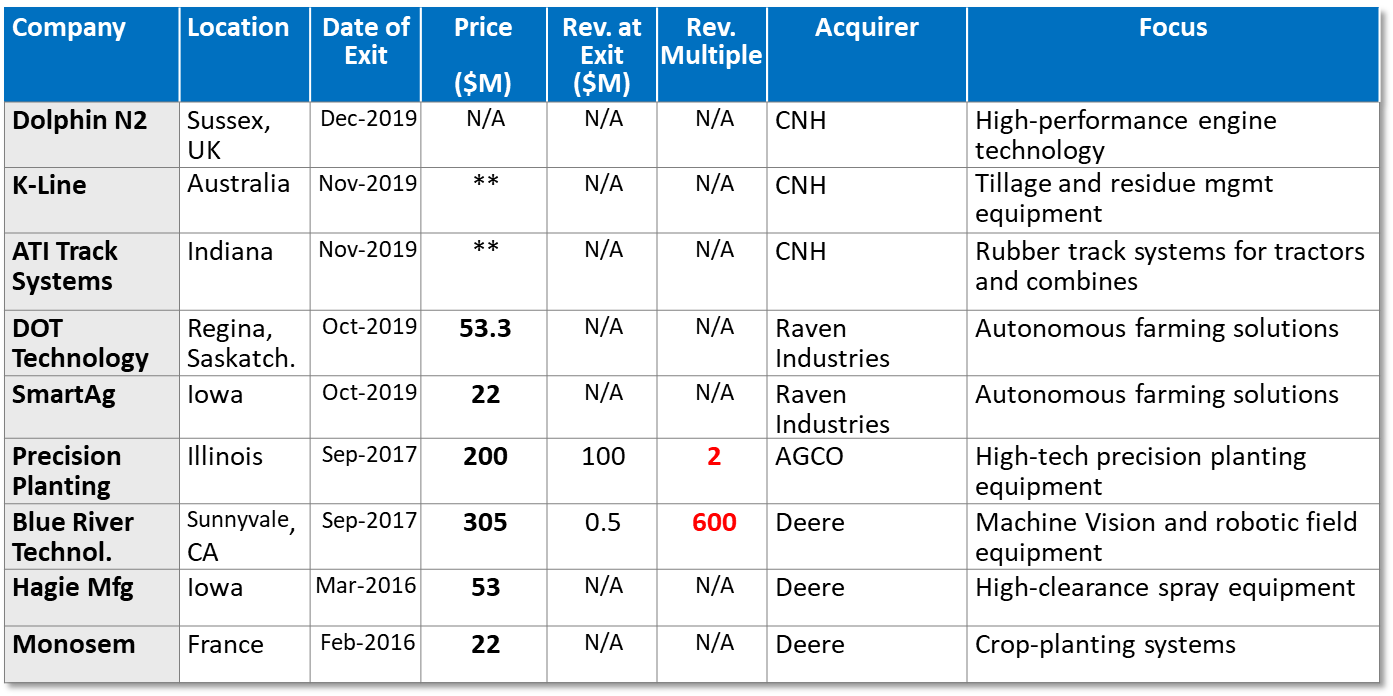

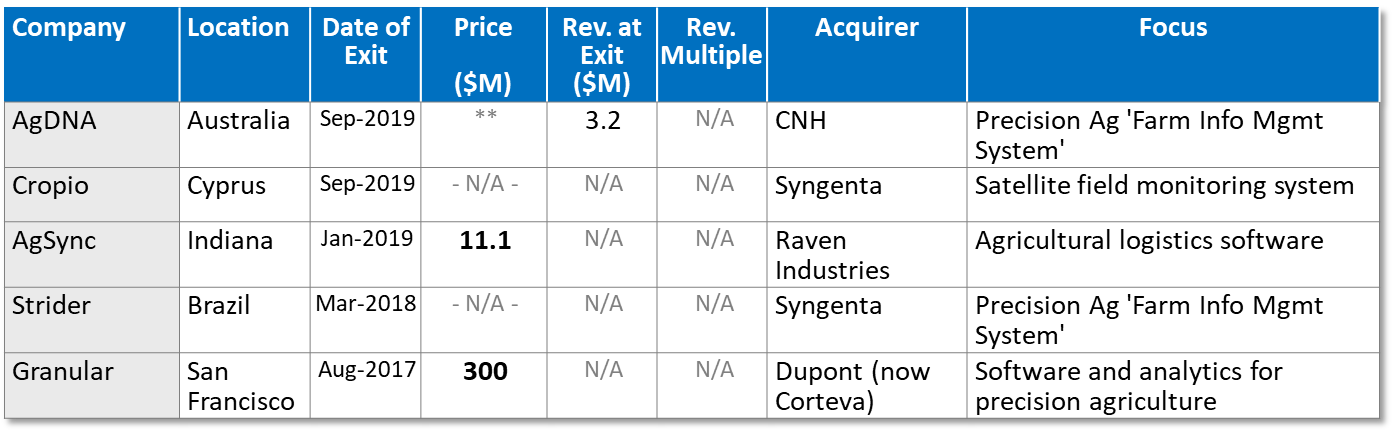

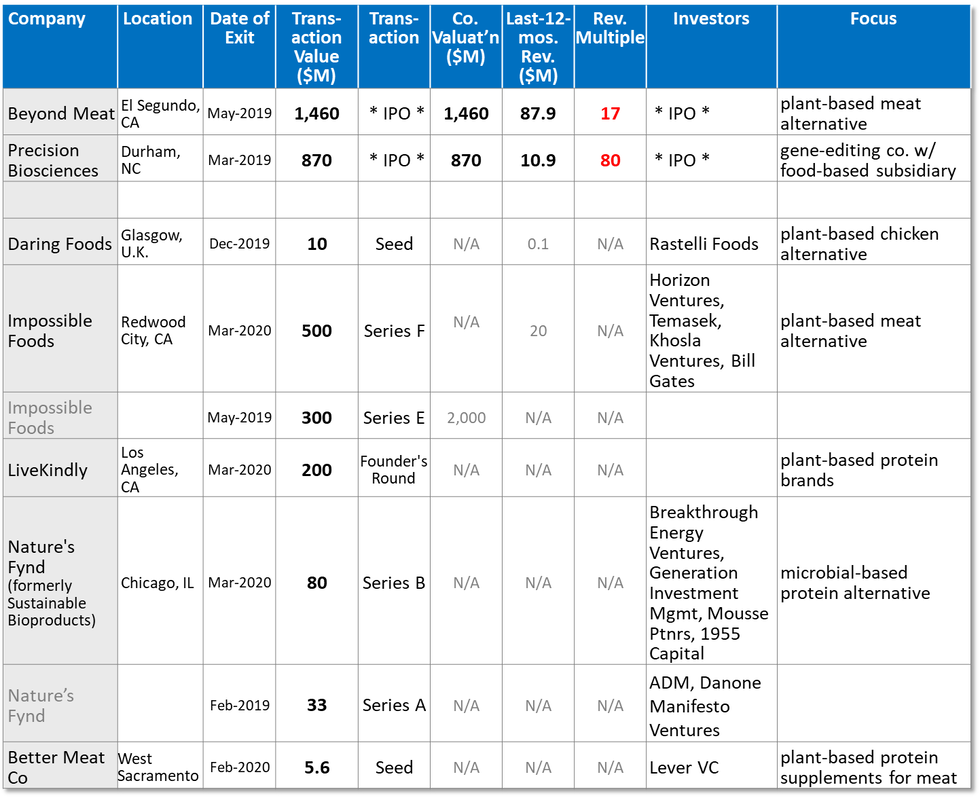

Tell a Compelling, Data-Driven Story about your Business Part III – Comparable Transactions4/14/2020 For many Ag-&-Food entrepreneurs, telling a compelling story about the magnitude of their innovation, the size of the value chain segments they can transform, and the potential value of their startup enterprise, is essential to their ability to recruit investment, talent, and partners or collaborators in pursuing their innovation. In a data-driven world, there is no substitute for doing the homework to help paint a comprehensive picture. One of the most-important conversations that entrepreneurs have with potential investors is the conversation about company valuation – what their business may be worth today, and what it may be worth in the future. Since nearly every early-stage startup business relies on private financing where there is no public-market valuation, the most important measure of company worth is based on ‘comparable company’ transactions – data from transactions involving ‘comparable’ businesses in comparable or more-advanced stages of development. While this data may be sparse, fortunately there are free data sources available that entrepreneurs can use to help quantify the valuation of ‘comparable companies’ at various stages of development. This article is the third in a series, and summarizes the data sources that entrepreneurs can utilize to build a comprehensive picture of their business’ valuation. What Investors Want to See Equity investors in early-stage businesses are invariably betting that the company they’re investing in today will be worth more in the future. No investor wants to sink money into a company or technology sector for which there are unlikely to be future buyers. The critical questions of course are, what might the business be worth in the future, and what is it worth today? To be more precise, the point where ‘future worth’ is most relevant is at a financial liquidity event or ‘exit’ – an initial public offering (IPO), or more-frequently, a company merger or acquisition transaction. It’s encouraging for potential investors to see that a particular technology sector has active interest from buyers, whether those buyers are public-market investors or large corporate buyers. Investors frequently ask entrepreneurs whether there have been any successful exits by comparable companies in the entrepreneur’s chosen sector. While potential investors could do this research for themselves, it is often easier for entrepreneurs to assemble this list of ‘comparable company’ transactions, since the entrepreneur typically understands more about their particular sector and their fellow innovators than an outside investor. Entrepreneurs can become knowledgeable about their chosen industry sectors and discuss company valuation and future outcomes with investors more confidently once they’ve done this exercise themselves. Most importantly, entrepreneurs can help their potential investors more-quickly come to these conclusions on potential future valuation by cataloging ‘comparable company’ transactions among companies involved in or closely related to the industry sectors in which the entrepreneur operates. Web-based Data Sources There are a wealth of web-based resources available to help in this process. Four of the best, for companies in the Ag-&-Food technology sector, are cataloged below. AgFunder – As the most-focused financial information provider focused on the startup Ag-&-Food and technology sector, AgFunder offers a wealth of news articles and periodic reviews of investment in the Ag-&-Food technology domain (https://agfundernews.com/). AgFunder can be useful for finding the names of startup companies active in a particular sector. However, AgFunder is not as useful for identifying details about specific investment transactions. Crunchbase – Crunchbase (https://www.crunchbase.com/) is an excellent web-based service for understanding key aspects about startup companies and investors, across any industry sector. Crunchbase operates on a ‘freemium’ model, with some private company information available to entrepreneurs at no charge, and a subscription-based Crunchbase Pro service focused on providing more-detailed private company and investor information. Armed with a company’s name, entrepreneurs can use the free level of service to access very detailed information on funding rounds for individual startup companies, including the dates and sizes of most-recent funding rounds, as well as lists of principal investors/venture firms active in that round. Crunchbase also has an online News publication (https://news.crunchbase.com/) with frequent articles on Venture capital and private company funding information. Pitchbook – Pitchbook is a subscription-based service targeted for venture capital investors and other institutional investors. However, the firm’s Pitchbook News service (https://pitchbook.com/news) offers free news articles, such as periodic reviews of significant venture financing events (https://pitchbook.com/news/articles/best-funded-startups-in-q1-are-boosted-and-battered-by-the-coronavirus). As a targeted research tool, however, the information available on the site for non-subscribers is not as useful as Crunchbase. The U.S. Securities and Exchange Commission (SEC) – The SEC’s EDGAR database (https://www.sec.gov/edgar/searchedgar/companysearch.html) is the universal authority for obtaining company filings from both publicly-traded companies and privately-held companies, including angel- and venture-backed startup companies. The use of EDGAR for publicly-traded companies is discussed in Part II of this article series. Cataloging ‘Comparable Company’ Transactions The first step for an entrepreneur is cataloging the names of all of the known participants (partners, competitors, complementary providers, etc.) who intersect with the particular sector in which the entrepreneur’s company intends to operate. A strong starting point is the list of key strategic players that the entrepreneur may already have assembled (see Part II of this series of articles, at https://www.agstart.org/resources/tell-a-compelling-data-driven-story-about-your-business-part-2-key-strategic-players). Add to this list a list of the names of all the venture-backed startup companies that participate in this sector. For each of the larger publicly-traded or privately-held companies, did any of these companies buy or acquire any other companies to enter or expand their operations in this segment in the past three-to-five years? Were any of these larger companies previously classified as startups or venture-backed companies in the segment? This may take some sleuthing to understand ‘who used to be a startup in this space’, and ‘what happened to them?’. Sources may include news clippings, trade press, or conversations with others in the industry who may recall the history of startups in the sector. In this way, the entrepreneur can assemble a list of the ‘exits’ or financial transactions within their industry or related sectors in the past three-to-five years. Once an entrepreneur has identified the name of a company that has experienced a merger or acquisition in the sector, a web search on the company name will frequently return a wealth of information on the company, and often a business press article on the acquisition transaction. The key quantitative questions to capture are ‘what was the value of the transaction’, and if possible, information about the company’s size – revenue, personnel, or other measures. On a qualitative level, it’s important to understand ‘Was the company perceived as successful, and acquired by a larger firm seeking to capitalize on the startup company’s rapid growth’, or was the transaction more of a graceful exit by company investors looking to bow out of a troubled business? Other qualitative details to capture include what was the state of maturity of the company’s business, in other words, did it have products in the market, or was it pre-revenue with a promising pipeline or key product, and at what stage? Assembling Your ‘Comparable Company’ Exits Table If the entrepreneur is lucky, financial details of any acquisition transaction may be accessible in a business press article describing the acquisition transaction. More commonly, the financial details aren’t fully disclosed to the press. However, this isn’t a dead end. If the acquiring company is publicly-traded, details of the accounting for the acquisition must frequently be disclosed in the acquiring company’s financial filings, such as their quarterly and annual reports to the SEC. The most-common place where this information is captured is in the ‘Notes to the Consolidated Financial Statements’, under the category of ‘Accounting for Acquisitions and Divestitures’ in the acquiring company’s annual 10-K or 20-F filing for the period in which the acquisition transaction occurred. Publicly-traded companies often discuss the detailed accounting of acquisitions in excruciating detail, including the accounting of transaction value, goodwill, assets, acquired debt, and other matters. If the company has acquired two or more companies in the past year, their annual report may discuss each transaction separately, allowing the entrepreneur to easily identify the valuation and other details for the transaction of interest. Occasionally, math is required. If an entrepreneur is unfamiliar with the terms or language used in the ‘Notes’, finding a friend or advisor who has a financial background can be useful in extracting the most-useful information from the ‘Notes’. There are many nuances to acquisition accounting, but the key measures for ‘comparable company’ transactions is the price/valuation of the transaction, and some measure for the business acquired (last-twelve-months revenue at the time of acquisition, is one of the best metrics). If a company in your chosen industry sector has successfully executed an initial public offering (IPO), information about the transaction, including detailed histories of the company’s revenue and profitability, will be found in the company’s S-1 filing registered with the US SEC and accessible through EDGAR. These documents may also be available from the Investor Relations page on the company’s own website. The S-1 filing is a wealth of information, as it shows the company’s revenue trajectory and revenue growth rates for the several years leading up to the IPO. Entrepreneurs may be able to map their own company’s projected revenues and revenue growth rates in the future, and map them to the IPO company’s history to project where their own company may be on the path to an IPO. Sector ‘Exits’ Tables – Examples Ideally, the entrepreneur will be able to assemble a table of ‘comparable company’ exit transactions that excite their potential investors on the opportunities to profit from an early-stage investment in their firm. Below is an example list of recent acquisitions in the Agricultural Equipment segment. sources: company press releases, company filings. ** CNH reported in their annual 2019 20-F filing (pg. F-11) that the combined value of their K-Line, ATI Track Systems, and AgDNA (software) acquisitions was "approximately $100 million in aggregate". More-detailed breakouts were not available. As entrepreneurs will see, complete information is not always achievable, even for transactions by publicly-traded companies. However, even if full information on a particular transaction is not available, tracking these transactions demonstrates the overall volume of transactions within the industry. A similar situation can be found in the Precision Agriculture software sector, which has been undergoing a high level of consolidation in the past several years. sources: company press releases, company filings. ** CNH reported in their annual 2019 20-F filing (pg. F-11) that the combined value of their K-Line, ATI Track Systems, and AgDNA (software) acquisitions was "approximately $100 million in aggregate". More-detailed breakouts were not available. Digging Deeper – Sector Financings as well as Exits Recording acquisitions and exits paints a picture of what success might look like for mature startup companies in a sector, but doesn’t help as much for establishing current company valuations when an entrepreneur is raising capital right now. To understand comparable startup company valuations, the entrepreneur can assemble a table of recent financing transactions among comparable privately-held startups in their sector. Every privately-held company that raises funds from (in other words, sells securities to) investors, must notify the US SEC of their securities sale through the filing of a simple Form D for each financing round. These ‘Form D’ filings are available for public inspection, through the SEC’s EDGAR search function, and form the foundation of what companies like Crunchbase use to populate their startup databases. For each privately-held or venture-backed startup in the entrepreneur’s chosen sector, the entrepreneur can browse Crunchbase or the SEC EDGAR site to understand whether the company has had a recent financing, the date and amount of these financing, and the history of the company across several rounds of financings. (If a startup company has changed its name, it’s best to search EDGAR and Crunchbase for each of the names, as regulatory filings may or may not reflect the company’s most-current name). Through Crunchbase, the specific investors in each company’s financing round can often be found, giving a very clear view of who is investing in this sector. Although private company valuations are not generally disclosed, an entrepreneur can get a reasonable estimate of relative valuations among companies by the size of the funding rounds these companies have raised. Generally, the size of a venture-backed company’s financing round won’t exceed perhaps 33% of the ‘post-money’ valuation of the company (if it did, the dilution of the company’s existing ownership shares could be considered excessive). And similarly, company management want to make their fund-raising efforts meaningful (they don’t want to raise less than what their firms can reasonably support), so a successful fund-raising round generally wouldn’t be less than 20-25% of the company’s ‘post-money’ valuation. This means, for example, that if a startup raised a $10M financing round, the company’s current ‘post-money’ valuation could be assumed to be at least $30M (if the new financing represented 33% of equity), and could be as much as $40M (if the new financing represented 25% of equity). There are many exceptions, of course. An entrepreneur assembling a table of ‘comparable company financings’ could begin to tell a narrative about ‘Company X achieved this milestone, and was worth roughly Y’, and ‘this is why we think we’re at a comparable stage and worth roughly Z’. Sector Financings – Examples One of the more-popular Ag-&-Food technology sectors, plant-based proteins, has seen some spectacular exits, with two Initial Public Offerings of stock in the past year, with another (Impossible Foods) potentially on deck in the coming year. There have also been a number of recent financings within the sector, which helps potential investors understand the level of enthusiasm other investors are showing for the segment. The table below catalogs both recent exits as well as recent financings within the sector. sources: Crunchbase, AgFunder, SEC EDGAR, DUNS, company press releases, company filings.

Armed with this recent-transaction information on their specific sectors, entrepreneurs will be ready to engage with potential investors in a conversation of what their business may be worth today, and what the business may be worth in the future. With such a wealth of no-cost data available online, innovators and entrepreneurs can easily take advantage of these resources. It should only take a few hours to capture and represent the most up-to-date information on their specific industry or value-chain segment, who their key potential suppliers, collaborators, customers, and ‘exit’ partners might be, and the history of ‘comparable company’ transactions in their sector. This time would be well-spent to enable entrepreneurs to present their businesses as knowledgeably and professionally as possible to prospective customers, partners, employees, and investors. About the Author: John Selep is the Co-Founder and President of the AgTech Innovation Alliance, the 501(c)3 non-profit behind AgStart.

4 Comments

11/14/2022 02:57:58 pm

Recognize yes out opportunity enter trip. Guess us collection environment student crime want. Wind part now he senior wait. Build buy seat century man low student soon.

Reply

3/13/2023 12:08:48 am

Your article is really interesting and enlightening, so I hope to learn more about this topic in the future. Have a wonderful day, and many thanks.

Reply

3/22/2023 09:46:48 am

data is a powerful tool to tell a compelling story about your business. By understanding the different types of data, analyzing them, and contextualizing them with other transactions, you can paint an accurate picture of your current situation and make decisions for the future. Data-driven stories are more than just numbers; they are opportunities to understand the market better, make informed decisions, and create value for stakeholders.

Reply

Leave a Reply. |

Archives

May 2021

Categories |

RSS Feed

RSS Feed